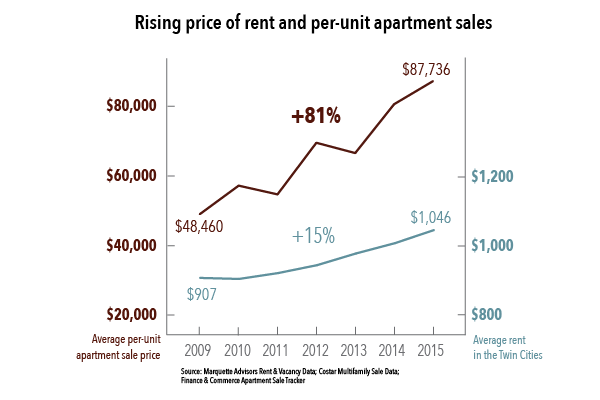

Housing advocates in Minnesota have a new resource to better understand the recent rapid rise in rents throughout the Twin Cities metropolitan area with the Minnesota Housing Partnership’s release of Sold Out on October 3. The report illustrates the increase in rental property sales and the neighborhoods most impacted. Key findings show that the average purchase price of apartment properties increased by 56% between 2010 and 2015 to $87,700 per unit. Between 2014 and 2015 sales of rental properties increased 36% from the preceding two-year period. Sold Out also reveals that neighborhoods with moderate median incomes and higher rates of racial diversity are more likely to have high rates of turnover. These sales are often followed by modifications and improvements that constitute “upscaling” of the properties and leads to abrupt rent increases followed by resident displacement.

The rapid increase of rental property sales in the Twin Cities area is largely driven by an extremely low vacancy rate - just 2.6% in 2015. The Twin Cities rental housing market has had vacancy rates below 5% since 2010. Demographic changes in renter households also contribute to the growing perception of rental housing as a lucrative investment for purchasers. The fastest growing segments of the rental population were those with incomes between $50,000 and $99,000, which added 14,600 households between 2010 and 2015 at a growth rate of 19%, and those with incomes above $100,000, which increased by 70% over the same time period but in smaller numbers.

Sold Out utilizes multiple data sources to track and analyze the sale of 62,209 rental units between 2006 and 2015, plotting the location of each sale. While the central cities of Minneapolis and St. Paul account for 42% of the region’s total rental housing, only 37% of units sold were located in those cities. While property sales were much more frequent in the central city neighborhoods, the suburban properties sold had many more units per property—83 units per sale in suburban areas versus 32 units per sale in Minneapolis or St. Paul. Sales of larger properties in suburban areas often accounted for a larger portion of a given community’s rental housing stock, and the displacement of renters was more disruptive and visible.

Sold Out also provides profiles of Twins Cities renters, advocates, and service providers working to manage the rapid changes resulting from the rising sales of properties. The report recognizes some of the positive impacts of apartment property sales, which include extending the usable life of aging properties and increasing property tax revenues that can fund services. The report highlights the need for more resources to preserve unsubsidized affordable housing options, featuring the work of the Greater Minnesota Housing Fund’s pilot project to preserve naturally occurring affordable housing (NOAH) by purchasing properties at risk of being converted to upscale housing.

“After hearing stories of hundreds of families being displaced, we created the Sold Out report to better understand the changes occurring in the region’s rental market,” said Chip Halbach, Executive Director of the Minnesota Housing Partnership. “What we found should be a call to action, and we’ll continue to work with local partners to find solutions.”

For more information about Sold Out, contact Carolyn Szczepanski, Minnesota Housing Partnership’s communications and marketing manager at [email protected].

Read Sold Out at: http://www.mhponline.org/publications/sold-out