NLIHC released its annual report The Gap: A Shortage of Affordable Homes, finding the lowest-income renters in the U.S. face a shortage of approximately 7 million affordable and available rental homes. Drawing on multiple data sources, the report documents how the pandemic has exacerbated the housing crisis for the lowest-income renters. The report examines both short- and long-term policy interventions needed to address the immediate housing impacts of the pandemic and the underlying shortage of affordable housing.

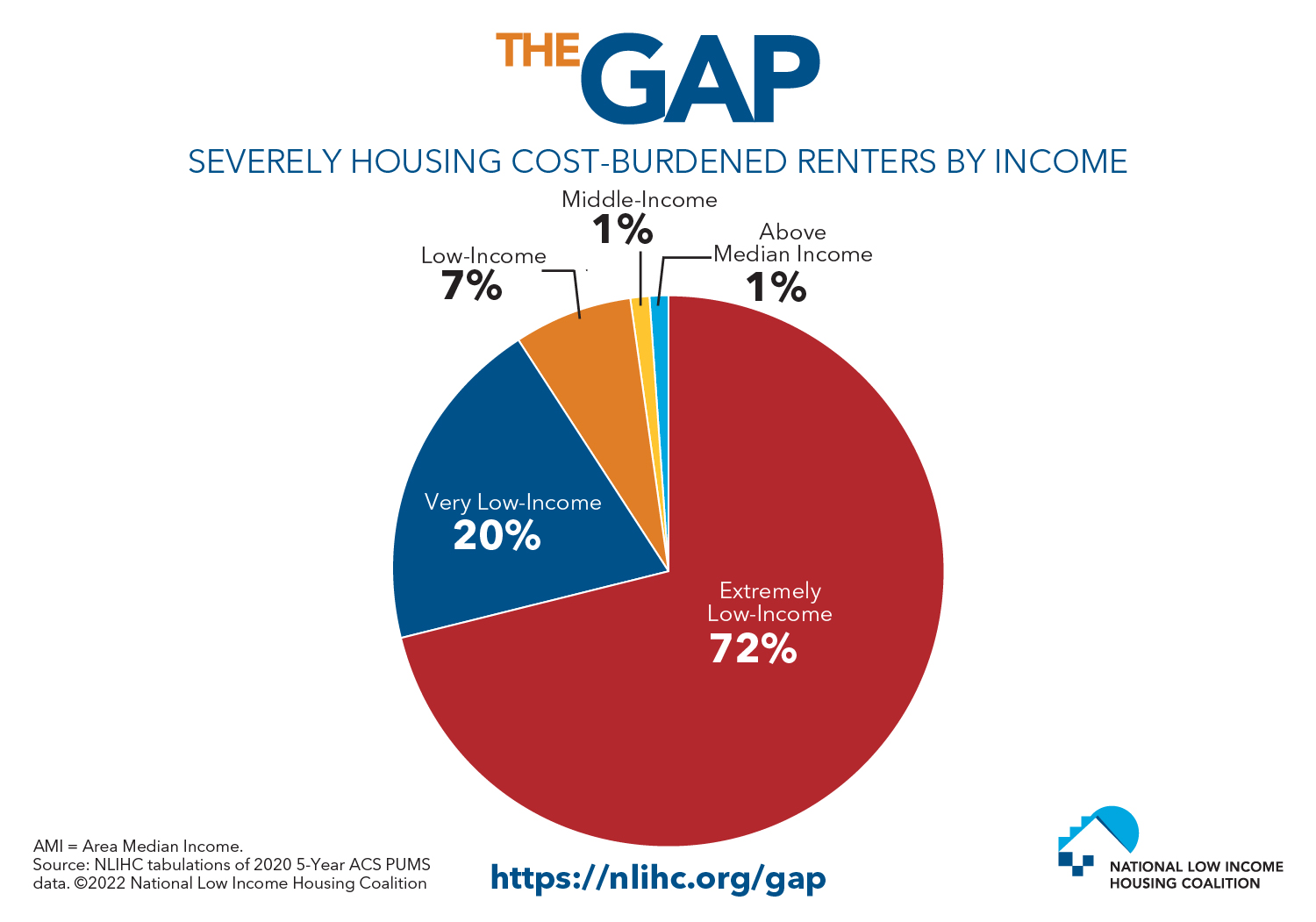

Fewer than four affordable and available homes exist for every 10 extremely low-income renter households nationwide. As a result of this shortage of affordable homes, 71% of extremely low-income renter households are severely housing cost-burdened, spending more than half of their limited incomes on housing. They account for more than seven of every 10 severely housing cost-burdened renters in the U.S.

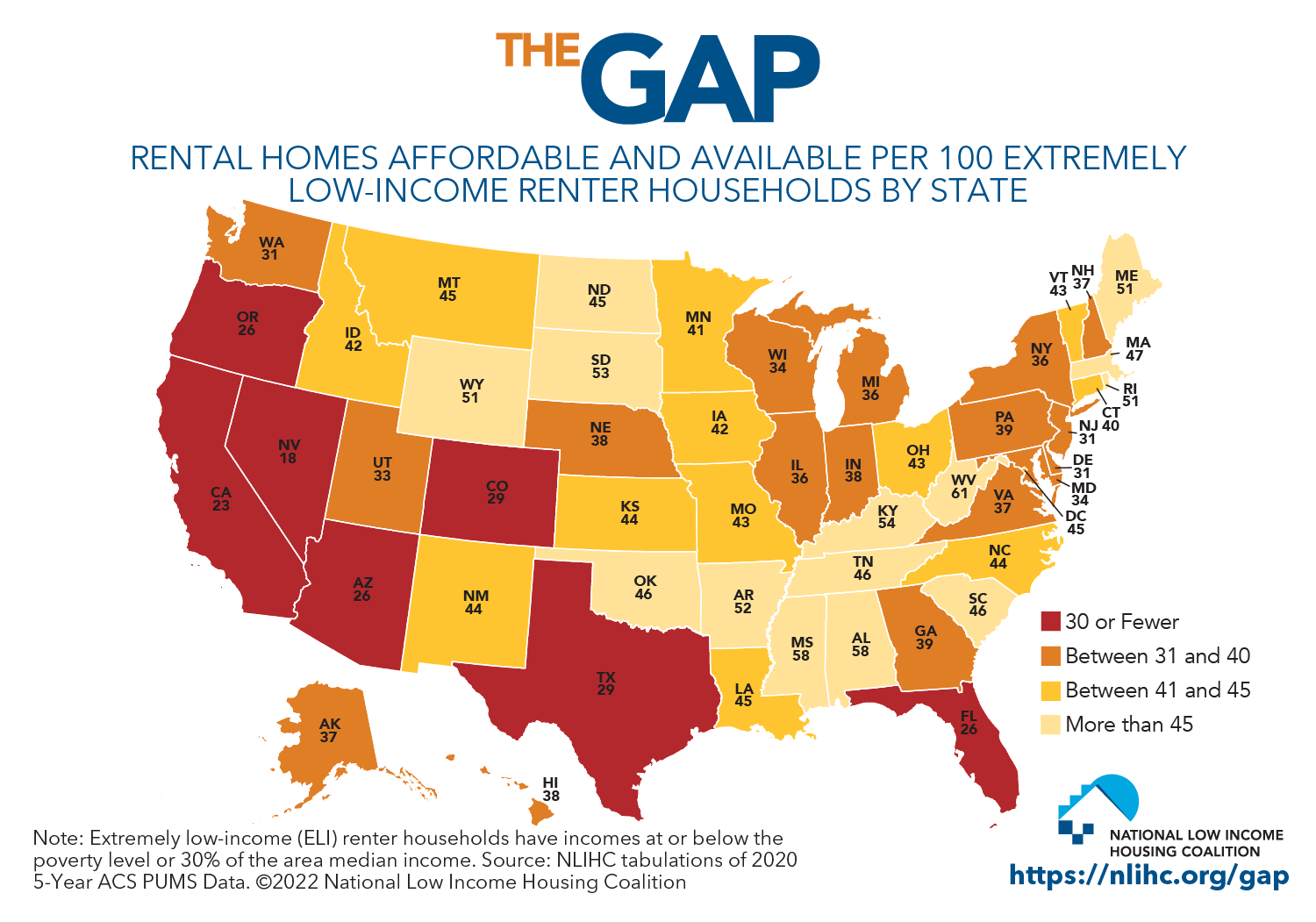

Every state and metropolitan area has a significant shortage of affordable rental housing for the lowest-income households. Statewide shortages range from just under two affordable and available rental homes for every 10 of the lowest-income renter households in Nevada to a little more than six in West Virginia. Across the 50 largest metropolitan areas, the shortage is least severe in Providence, Rhode Island, where there are five affordable and available rental homes for every 10 of the lowest-income renter households. The shortage is most severe in Las Vegas, Nevada, where there are fewer than two affordable and available rental homes for every ten of the lowest-income renter households.

The report also finds that systemic racism, both past and present, has left people of color disproportionately likely to be among the lowest-income renters facing a shortage of affordable housing. Twenty percent of Black households, 18% of AIAN households, 15% of Latino households, and 10% of Asian households are counted among the lowest-income renters, compared to only 6% of white non-Latino households. Black renters are especially likely to face eviction.

The report shows that these lowest-income renter households disproportionately suffered from the effects of lost income and housing insecurity during the pandemic. At one point – in January 2021 – nearly 8 million renters were behind on rent. The federal government took unprecedented actions to protect these renters. The government’s interventions, though, were temporary and limited in scope. Resources such as federal emergency rental assistance are now running out in many areas. Almost half of state programs funded by the U.S. Department of the Treasury’s Emergency Rental Assistance (ERA) programs could run out of funding by the end of 2022. Longer-term federal investments in affordable housing are needed to combat the underlying shortage of affordable housing that exposed the lowest-income renters to housing instability in the first place.

The report argues that Congress must make sustained investments in key HUD and USDA Rural Housing programs to address the underlying systemic shortage of rental homes affordable to the lowest-income renters. These investments should include significant commitments to deeply income-targeted programs such as the national Housing Trust Fund, Housing Choice Vouchers, and public housing. The funding levels for these programs in the House-passed “Build Back Better Act” provide a minimum benchmark for any new reconciliation bill in Congress. As The Gap demonstrates, the housing crisis for the lowest-income renters will persist long after the pandemic without such investments.

Read the 2022 edition of The Gap and explore an accompanying interactive map at: www.nlihc.org/gap