New Report Shows Potential $213 Billion in New Revenue from United for Homes Proposal

Dec 21, 2015

The Tax Policy Center (TPC) has released it most recent analysis of the United for Homes (UFH) proposal to reform the mortgage interest deduction (MID). Commissioned by NLIHC, the report shows the impact on revenue from federal income taxes if changes to the MID as proposed by UFH were enacted. An additional $213 billion would be generated over ten years if the two elements of the reform proposal were enacted. They are: lowering the cap on the amount of mortgage debt on which the interest can be deducted from the current $1 million to $500,000, and converting the current deduction to 15% non-refundable tax credit. Simply lowering the cap to $500,000 would generate $95 billion over ten years. Both of these figures assume the changes would be phased in over five years.

The Tax Policy Center (TPC) has released it most recent analysis of the United for Homes (UFH) proposal to reform the mortgage interest deduction (MID). Commissioned by NLIHC, the report shows the impact on revenue from federal income taxes if changes to the MID as proposed by UFH were enacted. An additional $213 billion would be generated over ten years if the two elements of the reform proposal were enacted. They are: lowering the cap on the amount of mortgage debt on which the interest can be deducted from the current $1 million to $500,000, and converting the current deduction to 15% non-refundable tax credit. Simply lowering the cap to $500,000 would generate $95 billion over ten years. Both of these figures assume the changes would be phased in over five years.

NLIHC has previously reported that only 5% of all mortgages made in the U.S. in the years 2012, 2013, and 2014 were above $500,000 and they are concentrated in a fraction of U.S counties.

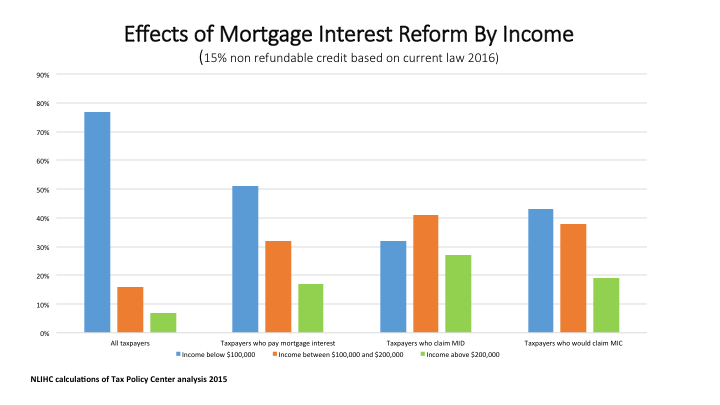

The TPC report also shows how the change to a 15% non-refundable tax credit would alter the distribution of mortgage interest tax breaks by income. While 34% of all taxpayers pay mortgage interest, only 58% of those who pay mortgage interest take the mortgage interest deduction. Under the UFH proposal, 82% of taxpayers who pay mortgage interest would get the mortgage interest tax credit, almost 15 million more homeowners with mortgages than get a tax break now.

The figure below illustrates this distribution by income group, clearly showing the increased benefit to lower income homeowners from the conversion from a tax deduction to a tax credit.

The UFH campaign proposes to use savings generated by MID reform to fund the National Housing Trust Fund and other housing assistance that benefits extremely low income households. To learn more about the campaign and the proposal, go to www.unitedforhomes.org.

The Tax Policy Center is a joint project of Brookings and the Urban Institute. To read the TPC paper, entitled Options to Reform the Home Mortgage Interest, go to http://www.taxpolicycenter.org/UploadedPDF/2000542-options-to-reform-the-deduction-for-home-mortgage-interest.pdf.

To read NLIHC’s report on mortgages over $500,000, go to http://nlihc.org/research/rare-occurrence.