NLIHC’s Analysis of the Middle Income Housing Tax Credit Bill

Oct 03, 2016

Last week, Senator Ron Wyden (D-OR) introduced S.3384, the Middle Income Housing Tax Credit Act of 2016, to create a new federal tax credit to incentivize developers to build and preserve housing that is affordable to families earning 100% of the Area Median Income (AMI) or below. Senator Wyden sent a Dear Colleague letter to Senate offices seeking cosponsors. The proposed Middle Income Housing Tax Credit (MIHTC) would cost $4.5 billion annually when fully implemented, according to NLIHC’s initial estimate. NLIHC opposes the bill and is urging all Senate offices to not cosponsor the legislation.

In a press release, NLIHC President and CEO Diane Yentel called the proposal “a misguided and wasteful use of federal resources.” She explained, “Given the growing affordable housing crisis, bold action is needed to serve more families in need. New federal resources must be targeted to serve those with the clearest and greatest needs—families with extremely low incomes (ELI). If enacted, Senator Wyden's bill would divert much-needed resources to higher-income households who, the data show, do not face significant housing challenges. Just 2% of middle-income renters nationwide are severely cost burdened, compared with 75% of the poorest renters paying more than half their income towards their rent.”

According to NLIHC’s report, The Gap: The Affordable Housing Gap Analysis 2016, nearly all of the need for affordable housing is concentrated among ELI families, not middle-income households. America’s 10.4 million ELI renter households face a shortage of 7.2 million affordable and available apartments. For every 100 ELI renter households, there are just 31 affordable and available rental homes. These households include seniors, people with disabilities and families with children who struggle to keep a roof over their heads.

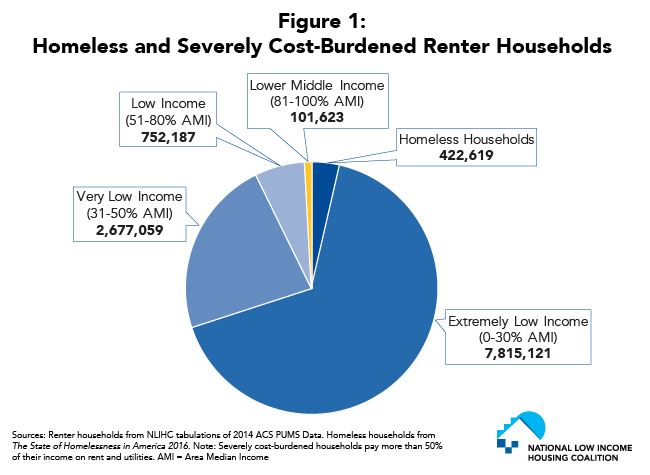

Because of this shortage, 75% of ELI households are severely cost burdened, paying more than half of their income towards their rent each month (See Figure 1). They face difficult decisions between paying rent and buying food or seeing a doctor and, in the worst cases, become homeless.

In comparison, just 2% of median-income families—or 101,000 households nationally—are severely cost burdened and there is an excess of homes affordable and available to them. For every 100 median-income households, there are 104 homes affordable and available.

S. 3384 would target scarce resources to the 100,000 middle-income renters who are severely cost burdened, while providing minimal benefit to the lowest income families paying more than half their income on rent.

For the few communities where providing affordable housing to middle-income households is a challenge, NLIHC recommends alternative solutions. S. 3237 is a bipartisan proposal by Senators Cantwell (D-WA), Hatch (R-OH), and Wyden (D-OR) that would, along with significantly expanding the Low Income Housing Tax Credit (LIHTC) program, provide additional flexibility for LIHTC to serve higher-income families. By allowing “income averaging” in certain LIHTC developments, the proposal would help high-cost cities serve families up to 80% of AMI, as long as the average income across the entire development remained at 60% of AMI.

Building and preserving affordable housing targeted to ELI families through the national Housing Trust Fund would also benefit middle-income families. Because of the significant deficit in homes affordable to the lowest income people, most ELI families rent apartments that they cannot afford that would otherwise be available to higher-income families. As the shortage of housing targeted to ELI households decreases, the rental market would become better aligned to meet all of the needs in a community.

See NLIHC’s Press Release at: http://nlihc.org/press/releases/7163

See NLIHC’s Call to Action at: http://bit.ly/2dhI9zM

See NLIHC’s Factsheet on S.3384: http://nlihc.org/sites/default/files/MIHTC-Factsheet_1016.pdf

Compare the housing needs of ELI and middle-income families in your state: http://bit.ly/2dLz727