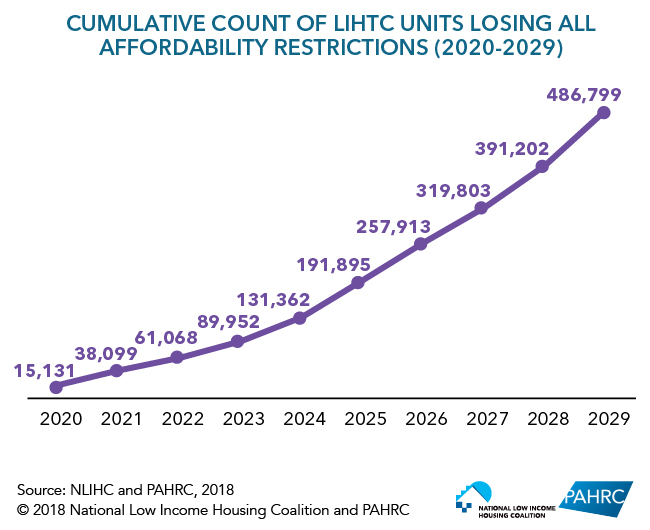

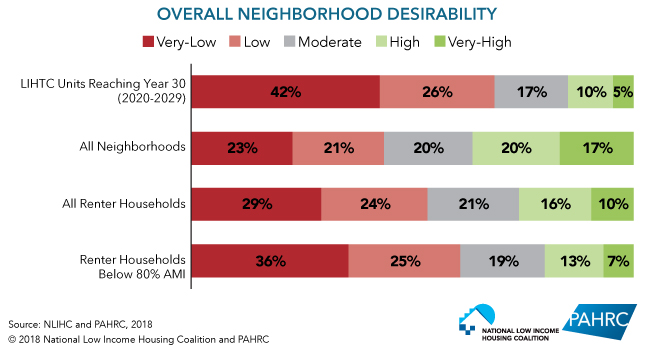

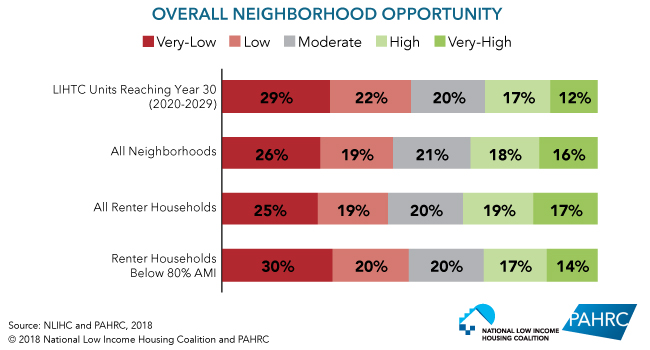

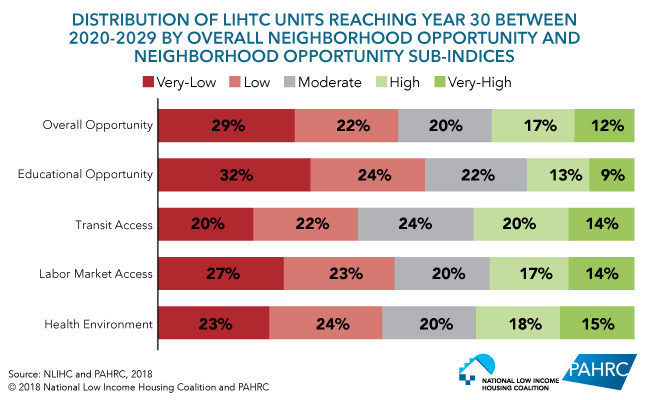

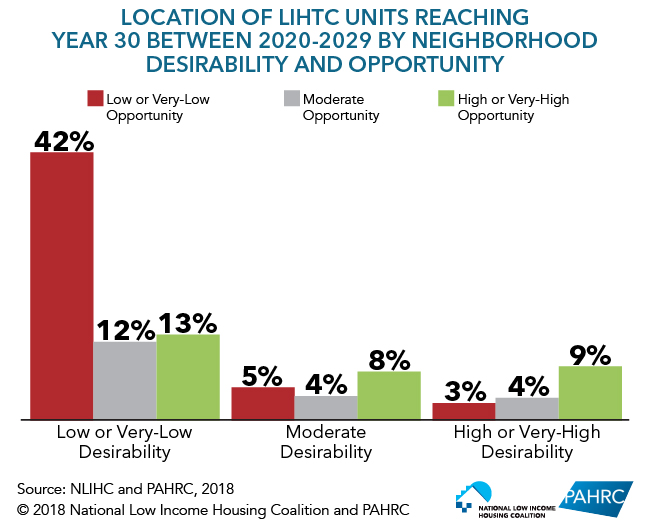

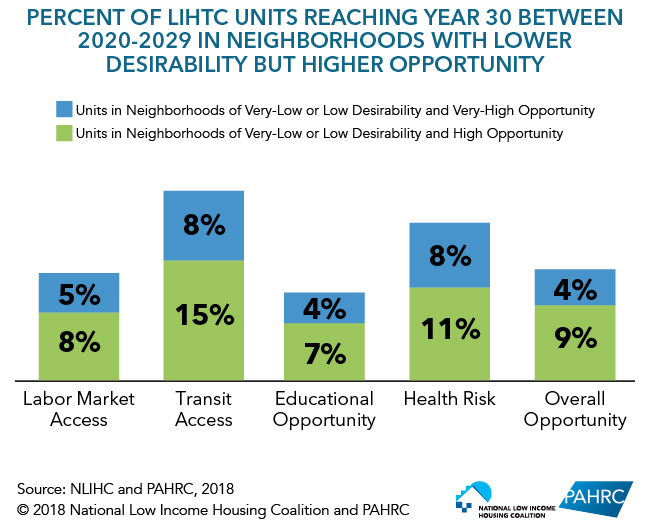

The Low-Income Housing Tax Credit (LIHTC) is the largest national affordable housing program in the U.S. By 2030, nearly half a million current LIHTC units, or nearly a quarter of the total stock will reach the end of all federally mandated rent-affordability and income restrictions. Some of these units will be lost from the affordable housing supply as they convert to market-rate rents. Others may be lost to physical deterioration unless new capital investment is available for rehabilitation and renovation. This report sheds light on these preservation challenges with an examination of the neighborhood characteristics of these LIHTC units and a discussion of how scarce resources for affordable housing lead to a dilemma between the priorities of preserving affordable housing and promoting mobility for low-income families to higher-opportunity neighborhoods. The report addresses this dilemma by offering a broader vision for a housing safety net.

The Low-Income Housing Tax Credit (LIHTC) is the largest national affordable housing program in the U.S. By 2030, nearly half a million current LIHTC units, or nearly a quarter of the total stock will reach the end of all federally mandated rent-affordability and income restrictions. Some of these units will be lost from the affordable housing supply as they convert to market-rate rents. Others may be lost to physical deterioration unless new capital investment is available for rehabilitation and renovation. This report sheds light on these preservation challenges with an examination of the neighborhood characteristics of these LIHTC units and a discussion of how scarce resources for affordable housing lead to a dilemma between the priorities of preserving affordable housing and promoting mobility for low-income families to higher-opportunity neighborhoods. The report addresses this dilemma by offering a broader vision for a housing safety net.

The report is based on data from the National Housing Preservation Database (NHPD) and other sources. The NHPD is a national database of federally assisted rental housing, which includes properties subsidized through HUD, USDA, and LIHTC. The NHPD gives stakeholders information on when and where affordability restrictions will expire. To learn more about the database, go to https://preservationdatabase.org/about-the-database/.

Click Here to View the Interactive PDF of the Report.

Click Here to View the Interactive PDF of the Report.

Click Here to Download a Print PDF of the Report.

Click Here to Download a Print PDF of the Report.

Report Graphics: