The Housing Trust Fund Project was initiated by Mary Brooks at the Center for Community Change in 1986 and has functioned as a comprehensive source of information on housing trust funds throughout the country for nearly four decades.

In 2024, NLIHC assumed the stewardship of the Housing Trust Fund Project as a resource to assist state and local efforts to advance housing trust fund initiatives.

Now Available! State & Local Housing Trust Fund Report

The report summarizes findings from a national survey of state and local housing trust funds distributed to administrators in February and March of 2025.

On this page:

- Overview

- State Enabling Legislation

- State Housing Trust Funds

- City Housing Trust Funds

- County Housing Trust Funds

- Regional Housing Trust Funds

Overview

Housing trust funds are established by elected government bodies—at the city, county, or state level—when a source or sources of public revenue are dedicated, by ordinance or law, to a distinct fund with the express and limited purpose of providing affordable housing.

Ideally, the funds are automatically transferred annually into the housing trust fund account, providing a continuous funding stream without going through an appropriation or budgeting process. Ideally, the funds can be used only in accordance with the enabling legislation or ordinance establishing the fund, targeted to serve the most critical housing needs. But these ideals are not possible in every situation, legally or politically.

The Housing Trust Fund Project advances the concept that a housing trust fund is created when public revenue sources are dedicated to this distinct fund. States may have constitutional or procedural issues that impact whether and how this can be done at the state, city, or county levels. Where legal barriers exist to dedicating public funds to a housing trust fund, housing advocates have worked around this in various ways. In such circumstances, a housing trust fund may be implemented with appropriated funds or funds that do not go through a budget process (such as state housing finance agency reserve funds or something structured as part of a bond package).

Housing trust funds are extremely flexible and can be used to support innovative ways to address many housing needs. The model can work in virtually any situation. They have been created to serve small towns of about 1000 people and the country’s largest states. These funds are also very efficient. Many housing trust funds report highly successful track records addressing a wide range of critical housing needs.

The housing trust fund model is just that—a model that defines a new objective for funding affordable housing, enabling the support of needed housing to be a fundamental part of what the government does. Some thirty years after the idea was formed, the model of dedicating public revenues to create a distinct fund supporting affordable housing has been embraced by hundreds of government bodies. The impact of housing trust funds can be felt in 49 states and Washington D.C., Guam, and Puerto Rico. There are at least 843 housing trust funds in cities, counties, and states that generate nearly $1.6 billion annually to support critical housing needs, underscoring the integral role these funds play in affordable housing. They exist because community organizers, housing advocates, elected officials, and other allies have agreed that a permanent stream of revenues for affordable housing should be a public priority.

State Enabling Legislation

‘State enabling legislation’ refers to a range of initiatives taken at the state level to make it possible, easier, or even encourage cities and/or counties to create their own housing trust funds. These range from states passing legislation enabling cities or counties to create housing trust funds to legislation that actually identifies a revenue option and provides matching funds. These initiatives have had the most prolific impact on the increase of local housing across the United States, leading to the creation of hundreds of housing trust funds across fourteen states.

Here is a brief description of the legislation in place, separated into three categories:

- State Enabling Legislation for Local Housing Trust Funds

- Enabling a Revenue Source Option for Local Housing Trust Funds

- State Funds to Support Local Housing Trust Funds

State Enabling Legislation for Local Housing Trust Funds

Arizona

The Arizona legislature enacted a law in 2007 that permits general-law counties to establish housing trust funds, pursuant to A.R.S. 11-381. The county board of supervisors may establish a county housing trust fund by resolution, administered by a housing trust fund board or the board of supervisors. Funds are to serve low-income households, with priority given to funding activities that provide for operating, constructing, or renovating housing for low-income households and for families with children.

Massachusetts

The Massachusetts legislature passed the Municipal Affordable Housing Trust Fund Law in 2005, simplifying the process of establishing a local housing trust fund. The legislation enables local legislative bodies to adopt municipal affordable housing trust funds by a majority vote. These entities must fund the creation and preservation of affordable housing for low and moderate-income households, as well as community housing. The Act also mandates that each entity have a board of trustees, and clearly states the role of the board. As of 2023, over 140 municipalities have established Municipal Affordable Housing Trust Funds.

Minnesota

The Minnesota Legislature enacted legislation in 2017 that allows local governments to establish a housing trust fund or to participate in a joint powers agreement to establish a regional housing trust fund, with the following criteria:

- eligible activities: the development, rehabilitation, and financing of affordable housing, rental assistance, down payment assistance, and homeownership counseling;

- ability to award funds through grants or loans;

- limit of 10% for administrative expenses;

- ability of a local government to assign the administration of the housing trust fund to a nonprofit organization; and

- requirement for annual reporting made available to the public

The legislation also lists potential revenue sources, including but not limited to bond proceeds, appropriations from local government, investment earnings of the fund, housing and redevelopment authority levies, state and federal funds, and private contributions.

South Carolina

The South Carolina legislature passed enabling legislation (the Mescher Act of 2007— H3509) for a municipality, county, or regional housing trust fund to be created by ordinance. The funds are to promote new construction or rehabilitation of affordable housing with a preference to households earning no more than 50% AMI. The funds are to be administered by a nonprofit organization with annual reports submitted to the local government and available to the public.

Indiana

The Indiana legislature passed legislation in 2007 that enables a county containing a consolidated city that has adopted a housing trust fund to authorize the county recorder to charge a document recording fee of $2.50 for the first page and $1.00 for each additional page, and to commit 60% of the revenues collected to the local housing trust fund. The remaining 40% goes to the state housing trust fund. The trust fund provides grants and loans for affordable housing for households with incomes at or below 80% AMI, with half of the funds serving those earning no more than 50% AMI; administrative expenses of the fund; and technical assistance to nonprofit developers of affordable housing. The housing trust fund has an appointed eleven-member advisory committee composed of community members and the housing industry to advise on policies, procedures, and long-term capital.

Massachusetts

The Massachusetts legislature enacted the Community Preservation Act (CPA) in 2000, which permits communities to adopt the CPA by passing, through a public vote, a surcharge of up to 3% on real property taxes. The funds must be used for open space protection, historic preservation, affordable housing, and outdoor recreation, and at least 10% of the revenues collected must be spent in each area. The CPA statute also creates a statewide Community Preservation Trust Fund, which distributes funds yearly to communities adopting CPA. Each CPA community creates a five-to-nine-member board that recommends CPA projects to the community’s legislative body. Community housing is defined as low and moderate-income housing for individuals and families. Each property purchased with CPA funds must remain permanently affordable, which is recorded in an individual deed or covenant specific to the property. As of 2024, at least 189 Massachusetts cities and towns have adopted the CPA.

Missouri

The Missouri legislature passed the Missouri Homeless Families Act in 1990, enabling three first-class counties to use document recording fees for homeless programs. A majority of the voters must approve a user fee of $3.00 on all recordations. The funds may be used to provide services, shelter and housing, and other activities to prevent homelessness. The three counties that qualify are St. Louis County, St. Charles County, and Jackson County. All three have approved these funds.

New Jersey

New Jersey Supreme Court decisions, referred to as the Mount Laurel rulings, resulted in the passage of New Jersey’s 1985 Fair Housing Act. Municipal land use regulations that prevent affordable housing opportunities for low- and moderate-income households were ruled as unconstitutional and the Fair Housing Act required all New Jersey municipalities to plan, zone for, and take affirmative actions to provide realistic opportunities for their fair share of the region’s need for affordable housing for low and moderate income people. Local jurisdictions can levy fees on developers to raise funds for affordable housing.

This Act has resulted in 318 municipalities (more than half of the jurisdictions in New Jersey) collecting fees for local housing trust funds. Residential and non-residential development fees are permitted up to 1.5% of the equalized assessed value for residential development. All municipalities must collect a non-residential development fee of 2.5% of the equalized assessed value. Municipalities are also permitted to collect payments from developers in lieu of them constructing affordable units from developers whose sites are zoned for affordable housing. The municipality must use the payment in lieu of construction to provide affordable units elsewhere. New Jersey’s Fair Housing Act was amended in 2024 to require the State Department of Community Affairs to allocate need on a municipal fair share basis. A new Affordable Housing Dispute Resolution Program has been established in the Administrative Office of the Courts to review and approve municipal housing plans to implement the local fair share obligation.

The New Jersey Legislature passed legislation in 2009 creating the county-based Homeless Trust Fund opportunity. Public Law 2009 Chapter 123 permits a county to add a surcharge of $3 on each document recorded within a county for deposit into a county homelessness trust fund. Eight counties have County Homeless Trust Funds: Bergen, Camden, Hudson, Mercer, Middlesex, Passaic, Somerset, and Union.

Oregon

In 2016, the Oregon legislature enacted SB1533 B, authorizing cities and counties to impose a Construction Excise Tax (CET) on new construction or construction adding square footage to an existing structure:

- Residential construction, at a rate of 1% of the value of the permit value of the construction.

- New commercial and industrial construction, with no cap on the rate of the CET.

The local government imposing the CET may retain 4% of CET revenues as a fee for administering the tax. After this fee, the residential CET revenues are to be distributed as follows:

- 50% to developer incentives as set out in Section 1 of the bill.

- 15% to the Oregon Housing and Community Services Department to fund homeownership programs that provide down payment assistance.

- 35% for affordable housing programs and incentives as defined by the local jurisdiction.

For a CET imposed on commercial or industrial development, 50% of revenues after the administrative fee must be spent on housing programs.

Pennsylvania

The Pennsylvania Legislature passed the Option Affordable Housing Trust Fund Act in 1992, commonly known as Act 137, which permits counties to double document recording fees for deeds and mortgages by a vote of the county commissioners. The funds are to be used to increase the availability of quality housing for households earning less than the county’s median income. Fifteen percent of the funds may be used for administrative costs. The City/County of Philadelphia was originally excluded from the legislation, but Act 49 amended the Optional Affordable Housing Trust Fund Act in 2005, permitting Philadelphia to participate.

The Pennsylvania legislature created PHARE (Pennsylvania Housing Affordability and Rehabilitation Enhancement Act) in 2013—a state housing trust fund which receives revenue from the Marcellus Shale Impact Fee legislation (subsequent legislation has added statewide funds from the future growth in revenue from the real estate transfer tax). The impact fee funds are distributed to counties impacted by unconventional gas wells. Half of the funds must go to rural counties. At least 30% of the funds must be targeted to households earning below 50% of AMI. Annual plans and reporting are required, and long term affordability is encouraged.

South Carolina

The South Carolina legislature passed Act No. 57 in 2023, which allows localities to use taxes collected on short term rental or hotel stays for workforce housing, including programs to promote homeownership opportunities. The legislation does not provide any new funding, rather it allows localities to earmark up to 15% of their accommodations tax revenue for housing. The provision sunsets December 31, 2030.

Washington

Since 1995, the Washington Legislature has enacted legislation that creates six distinct avenues for cities and/or counties to enact local housing trust funds with dedicated revenue. The first legislation was RCW 84.52.105, which authorizes a town, city or county to impose additional regular property tax levies of up to fifty cents per thousand dollars of assessed value of property in each year for up to ten consecutive years. The funds are to finance affordable housing for very low-income households. The levy must be approved by a majority of the voters. The governing body must declare the existence of an emergency with respect to the availability of housing for very low-income households and adopt an affordable housing financing plan for expenditures raised by the levy.

In 2002, the legislature passed RCW 36.22.178, which increased document recording fees across the state and created the Affordable Housing for All Surcharge. Numerous amendments have been made including boosting the fee. In 2018 the legislature passed HB 1570 to increase the Affordable Housing for All surcharge from $40 to $62 and remove the sunset clause, making the fee permanent. The bill also expanded the definition of “private rental housing,” allowing private rental housing payments funded by a 45% set-aside of surcharge funds to include housing owned by nonprofit housing entities. Counties are permitted to retain up to five percent of fees collected for administrative costs and funds distributed to counties for use by the county (and its cities and towns) are for affordable housing activities that serve very low-income households.

In 2015, the legislature passed RCW 82.14, RCW 43.185C, RCW 36.22.179 and HB 2263. RCW 82.14 authorizes a city or a county to impose a 1/10 of 1% sales tax for affordable housing, mental health facilities, operations and maintenance, and services. Funds for affordable housing, mental health facilities, and/or operations and maintenance must serve 60% AMI or below within certain population groups. Remaining funds would be used for behavioral health treatment programs and services or housing-related services.

RCW 43.185C and RCW 36.22.179 created the Homelessness Housing and Assistance Act and added a $10 document recording fee with revenues going directly to counties and a portion to the state Home Security Fund. The act requires homelessness plans by the counties and the state. RCW 36.22.179 was amended in 2022, and adds an additional surcharge of $62.00 to the document recording fee.

HB 2263 enables County legislative authorities to implement a 0.1% sales and use tax, if approved by a majority of voters, in order to fund housing and related services. In 2020, the legislature passed SHB 1590, which amended HB 2263 to give cities and counties the ability to implement the local sales and use tax for affordable housing through a council vote. A city may implement the whole or remainder of the tax if approved by a majority of voters and the county has not opted to implement the full tax. A minimum of 60% of revenues collected must be used for construction, operations and maintenance costs of affordable housing, facilities providing housing-related services, mental and behavioral health-related services or evaluation and treatment centers. Funds are to support individuals with income below 60% AMI, including: individuals with mental illness, veterans, senior citizens, homeless families with children, unaccompanied homeless youth, persons with disabilities, or domestic violence victims. A county may issue bonds against up to 50% of the revenues to support eligible construction activities; the remainder of the funding must be used for the operation, delivery, or evaluation of mental and behavioral health treatment programs or housing-related services. No more than 10% of the revenues collected may be used to supplant existing local funding for such services.

In 2019, the legislature enacted SHB 1406, which allows county and city legislative authorities to implement a local sales tax and retain a portion of the tax that goes to the state in order to fund affordable or supportive housing. The maximum rate imposed may not exceed either 0.0146 percent or 0.0073 percent.

Wisconsin

The Wisconsin legislature amended legislation in 2009 to allow tax increment financing to be used to fund affordable housing in cities throughout the state. The law enables municipalities to extend the life of expired tax increment districts for one additional year and use the funds to support affordable housing. At least 75% of the increments received are to benefit affordable housing in the city and the remaining 25% is to be used to improve the city’s housing stock.

Iowa

The Iowa Finance Authority administers the Iowa Housing Trust Fund, which was established in 2003. The Authority commits at least 60% of the funds to a Local Housing Trust Fund Program. The trust fund receives revenues from the state real estate transfer tax. To be eligible to apply for funding from the Local Housing Trust Fund Program, a local housing trust fund must be approved by the authority and have:

- A local governing board recognized by the city, county, council of governments, or regional officials as the board responsible for coordinating local housing programs.

- A housing assistance plan approved by the authority.

- Sufficient administrative capacity in regard to housing programs.

- A local match requirement approved by the authority.

The award from the Local Housing Trust Fund Program is not to exceed ten percent of the balance in the program at the beginning of the fiscal year plus ten percent of any deposits made during the fiscal year. Each local housing trust fund must submit a report annually to the authority itemizing expenditures. Funds are targeted to serve households at or below 80% of the state median household income. At least 30% of the trust fund money must be directed to households earning no more than 30% of the state median income.

Florida

The Florida Legislature passed the William E. Sadowski Act in 1992, which dedicates funds from the documentary stamp tax to a State Housing Investment Partnership program (SHIP) and the Florida Housing Finance Corporation. The SHIP Program provides funds to all counties and entitlement municipalities in the state. Local governments receive annual allocations, by formula, based on population. The minimum allocation is $350,000. In order to participate, local governments must establish a local housing assistance program by ordinance; develop a local housing assistance plan and housing incentive strategy; amend land development regulations or establish local policies to implement the incentive strategies; form partnerships and combine resources in order to reduce housing costs; and ensure that rent or mortgage payments within the targeted areas do not exceed 30 percent of the area median income limits.

California

California has taken several steps to advance local funding of affordable homes. For years, California communities benefited from the availability of redevelopment agency tax increment funds. The state required 20% of these funds be committed to providing and preserving affordable housing every year, which meant the state had $1 billion in funds each year to provide secure affordable homes. However, in 2011, Governor Jerry Brown eliminated the redevelopment agencies. A portion of the tax increment funds collected in redevelopment areas that originally went to the Redevelopment Agencies has now been redirected to each jurisdiction’s general fund. Two options are available to recapture the funding: (1) a portion or all of the redirected funds (referred to as boomerang funds) from the former Low and Moderate Income Housing Fund (the required 20% set aside) can be committed to affordable housing activities and (2) a portion or all of ongoing annual tax increment revenues can be committed to affordable housing. These efforts began in 2012.

California’s Department of Housing and Community Development (HCD) administers a Local Housing Trust Fund matching awards program. A $2.85 billion voter-approved housing bond in 2006 (Proposition 1C) has funded the program, which operates as a competitive grant program that helps finance local housing trust funds dedicated to the creation or preservation of affordable housing. Eligible applicants include cities, counties, and charitable nonprofit organizations.

State Housing Trust Funds

State housing trust funds are, by any measure, the backbone of the housing trust fund world.

They demonstrate what is possible, encourage local participation, and build enough momentum to begin having a measurable impact on addressing critical housing needs.

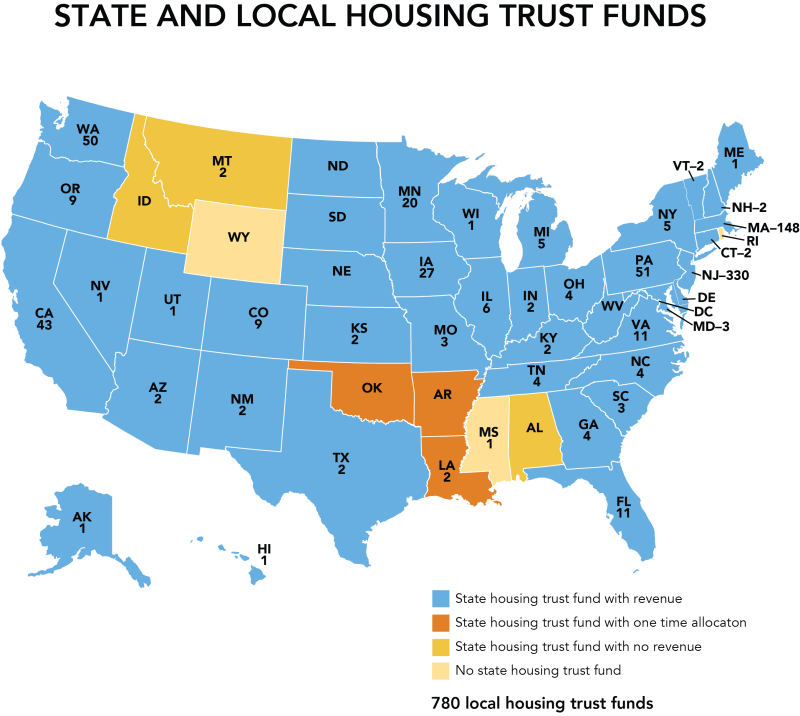

Forty-eight states, the District of Columbia, and the territories of Guam and Puerto Rico have created sixty-three housing trust funds. Nine states — Connecticut, Illinois, Kentucky, Massachusetts, Nebraska, Nevada, New Jersey, Oregon, and Washington — have created more than one state housing trust fund, reflecting a recognized value in committing public revenues to achieve specific objectives, such as addressing homelessness or providing rental assistance. View a list of state housing trust funds and the agencies that administer them.

Fourteen states — Arizona, California, Florida, Indiana, Iowa, Massachusetts, Minnesota, Missouri, New Jersey, Oregon, Pennsylvania, South Carolina, Washington, and Wisconsin — have passed legislation that encourages and/or enables local jurisdictions to dedicate public funds to affordable housing. For more information, see the section on state-enabling legislation.

State housing trust funds collected over $685 million in FY24 to advance affordable housing initiatives in their states. The most common revenue sources collected by state housing trust funds are the real estate transfer tax and the documentary stamp tax, used by fifteen states and the District of Columbia. Three state housing trust funds have received only a one-time infusion of funds (Arkansas, Louisiana, and Oklahoma), and four have yet to allocate any funds to their state housing trust funds (Alabama, Idaho, Montana, and Rhode Island). Get more information on state revenue sources. The average amount of public and private funds leveraged for every dollar invested in affordable housing by state housing trust funds is nearly $6.00, ranging from a low of $3.00 to a high of $22.00 for individual trust funds.

City Housing Trust Funds

Currently, there are a total of 596 city-led housing trust funds across the country, including 131 city housing trust funds in thirty-six states, 147 Municipal Affordable Housing Trust Funds in Massachusetts, and 318 Local Housing Trust Funds throughout New Jersey.

In FY24, housing trust fund revenues generated by cities exceeded $500 million. The most common revenue source collected by city housing trust funds is developer fees, used by at least fifty city housing trust funds and all jurisdictions in New Jersey. According to the 2025 State and Local Housing Trust Fund Survey Report, on average, cities leveraged $10.00 in other public and private funds for every dollar invested in affordable housing by city housing trust funds. The highest leverage reported was $38.00 for individual trust funds.

For a list of city housing trust fund revenue sources and administering agencies, click here.

County Housing Trust Funds

Currently, there are a total of 173 county-led housing trust funds in 22 states, with a majority in Pennsylvania (49), Washington (42), and Iowa (23).

In FY24, county housing trust funds generated more than $400 million. According to the 2025 State and Local Housing Trust Fund Survey Report, on average, counties leveraged $14 in other public and private funds for every dollar invested in affordable housing by county housing trust fund. The highest ratio reported was $ 1 to $41.

See a list of county housing trust fund revenue sources and administrative agencies.

Regional Housing Trust Funds

Regionalism has long been associated with affordable housing advocacy because the connection between where one lives, drives to work, goes to school, worships, and accesses services is all about geography. While having a regional or multi-jurisdictional housing trust fund is very strategic for providing housing solutions that respond to regional housing needs, the challenge of getting neighboring jurisdictions to share resources and administrative authority is significant. There are eleven multi-jurisdictional housing trust funds, including San Francisco City and County and Sacramento City and County in California; Aspen/Pitkin County and Telluride/San Miguel County in Colorado; Kalamazoo City & County in Michigan; Ithaca/Tompkins County in New York; Cleveland/Cuyahoga County and Columbus/Franklin County in Ohio; Beaufort and Jasper Counties in South Carolina; New River Valley Region in Virginia, and East King County, Washington.

Best known among the regional housing trust fund efforts is the East King County, Washington, housing trust fund administered by A Regional Coalition for Housing (ARCH). Created in 1993, King County and fifteen cities have entered into an interlocal agreement to cooperatively address affordable housing issues on the east side of King County, Washington. ARCH both administers the trust fund and provides technical assistance to participating jurisdictions. Representatives from ARCH member cities establish priorities for funding and approve awards from the trust fund, with final approval by participating city councils. Participating jurisdictions annually commit general funds, federal revenues, and other funds to the trust fund; some funds are redistributed rather than being spent solely in the contributing jurisdiction. The fund received more than $3 million in FY24, supporting over 400 households in East King County.

Perhaps the truest example of a multi-jurisdictional structure is the Affordable Housing Trust for Columbus and Franklin County (AHT) in Ohio; established in 2001, the AHT acts as an independent, not-for-profit lender to create affordable housing opportunities. AHT is funded by the City of Columbus and the Franklin County Board of Commissioners. The City appropriates hotel and motel taxes, as well as half of the revenue from an increase in the real estate conveyance tax, to the AHT. The Affordable Housing Trust hires its staff to operate the trust fund and is accountable to an appointed eleven-member Board of Trustees. Revenues are expected to reach $2 - 4 million annually.

The Beaufort Jasper Housing Trust is a multi-jurisdictional housing trust fund that includes participation from eight local jurisdictions: Beaufort County, Jasper County, the Town of Hilton Head, the Town of Bluffton, the City of Hardeeville, the Town of Yemassee, the Town of Port Royal, and the City of Beaufort. The regional housing trust fund was created after a 24-member steering committee, which included all eight participating jurisdictions, released a study in 2021 making the case for the regional housing strategy. The study interviewed local stakeholders and eight peer housing trust funds from across the US during the eight-month project timeline. Guided by the principles of the William Mescher Act in South Carolina, the final report was released in August 2021. In October 2022, those eight jurisdictions approved the formation of a Regional Housing Trust Fund. The Beaufort Jasper Housing Trust is a nonprofit entity. BJHT is a fully functional 501(c)(3) with its own Board of Directors. Each governing body has appointed a representative for the Beaufort Jasper Housing Trust.