Policy Update

Nov 17, 2017

Federal Budget Update

Congress has until December 9 to reach a deal to fund federal agencies and programs for the rest of fiscal year 2018 (FY18), which began on October 1, 2017. In September, Congress reached a deal to fund the government through a short-term spending bill to give lawmakers more time to negotiate an agreement to lift tight limits on federal spending that threaten investments in affordable housing and community development and millions of families with low incomes.

Since 2011, these spending caps have decreased funding for affordable housing and community development programs, impacting the ability of Congress to invest in proven solutions to address our country’s affordable housing crisis.

For example, HUD housing and community development funding was $4.3 billion or 8.4% lower in 2016 than in 2010, adjusted for inflation. The programs hardest hit by funding cuts have been Public Housing (-$1.6 billion), the Community Development Block Grant program (-$1.4 billion), the Home Investment Partnerships program (-$1.0 billion), and housing for the elderly and people with disabilities (-$641 million). Such cuts have made it more difficult to ensure low income seniors, people with disabilities, families with children, and other vulnerable populations are stably housed. Further budget cuts will continue to undermine this critical piece of the federal safety net.

For these reasons, NLIHC calls on Congress to lift the spending caps imposed by the Budget Control Act of 2011 and ensure the highest level of funding possible for affordable housing and community development.

Both the House and Senate have drafted FY18 spending bills for affordable housing and community development, but with the uncertainty around the federal spending process, it is unclear what the final version of the spending bill will look like.

Despite the difficult budget climate on Capitol Hill, the draft Senate spending bill for affordable housing and community development rejects President Donald Trump’s proposed budget, which would have enacted the deepest cuts to HUD programs since the Reagan administration. Overall, the Senate spending bill provides $1.4 billion more than the current year to HUD. The funding levels in the Senate bill are a direct result of strong advocacy by residents and affordable housing organizations throughout the country and the efforts of Congressional champions of affordable housing led by Subcommittee Chairwoman Susan Collins (R-ME) and Ranking Member Jack Reed (D-RI).

NLIHC and other advocates are concerned, however, that despite the increase in funding, the Senate bill may still not cover the full extent of inflationary costs, putting 60,000 vouchers at risk. It is imperative that Congress reach a budget deal to lift the spending caps and to fully fund affordable housing programs to ensure that no housing vouchers are lost.

Affordable housing and community development programs fare far better in the Senate bill than in the House version, which eliminates more than 140,000 housing vouchers that families are expected to use next year. Without housing assistance, families are at immediate risk of eviction and, in worst cases, homelessness. The House bill also reduces flexible resources used by states and localities to build and preserve affordable housing and address community needs. It undermines public-private partnerships that result in affordable homes for low income people, and the bill cuts funding used to keep families healthy and safe by removing lead and other harmful toxins from their homes.

The stage is set for a bipartisan budget deal, but housing advocates must continue to weigh in with their members of Congress to urge them to lift the spending caps and fully fund affordable housing investments.

Tax Cuts for the Wealthy at the Expense of Low Income Households Must Be Opposed

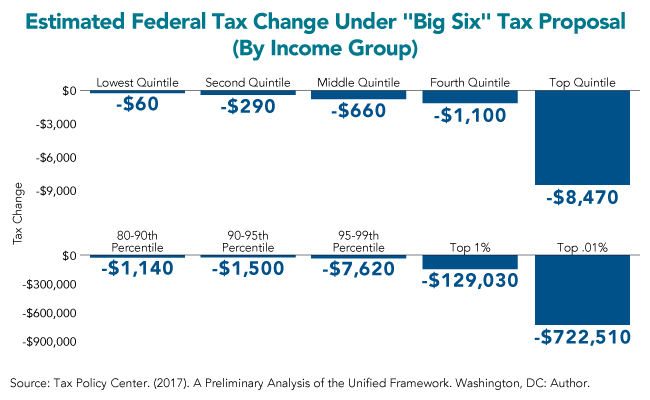

House Republicans released the Tax Cuts and Jobs Act on November 2 to make sweeping changes to the U.S. tax code. The plan takes a historic step in directly revising the mortgage interest deduction, a $70 billion annual tax expenditure that primarily benefits higher income households, including the top 1% of earners in the country.

The tax reform proposal makes sensible reforms in lowering the amount of a mortgage against which the mortgage interest deduction (MID) can be claimed to $500,000 for new home loans and doubling the standard deduction. This change to the MID would impact fewer than 6% of mortgages nationwide and would save an estimated $95.5 billion over the first decade.

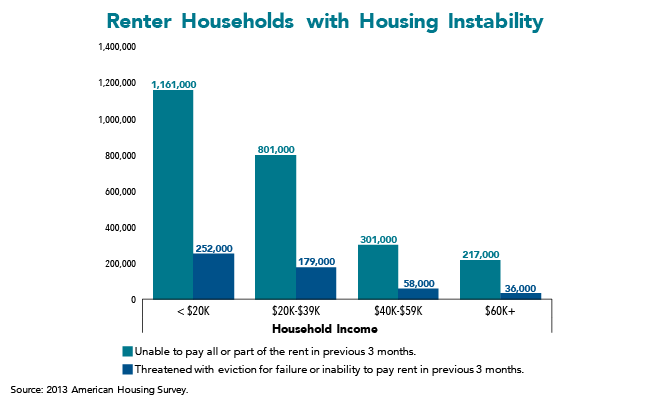

However, the legislation uses the savings generated by MID reform to pay for lower tax rates for billionaires and corporations without addressing the affordable housing crisis in America. This proposal is a non-starter. Instead, Congress should reinvest the savings from MID reform into affordable housing solutions that would help the lowest income people in America, who too often struggle to pay the rent and make ends meet.

The NLIHC-led United for Homes campaign calls on the president and Congress to embrace smart reforms to the MID. These include reducing the amount of a mortgage eligible for a tax break from $1 million to $500,000 – impacting fewer than 6% of mortgages nationally – and converting the deduction into a credit, providing a greater tax break to 25 million low and moderate income homeowners, including 15 million mortgage holders who currently do not benefit from the MID. These reforms would generate $241 billion in savings over 10 years that should be reinvested into critical rental housing solutions, not used to pay for lowered tax rates for wealthy individuals and corporations.

NLIHC has significant concerns with other provisions in the overall tax bill and further analysis is needed to determine the impact. We will continue to work with our members and partners to ensure that tax reform efforts do not enrich corporations and wealthy Americans at the expense of people with the lowest incomes.

New Renters Tax Credit Would Support All Low Income Households

Representative Joe Crowley (D-NY) introduced the “Rent Relief Act of 2017” (HR 3670) on September 1 to provide a renter’s tax credit to struggling families and individuals to help them afford to keep a roof over their heads. Mr. Crowley, chair of the House Democratic Caucus, serves on the House Ways and Means Committee, which writes the tax laws.

Rent Relief Actof 2017 outside the

Woodside Houses in Queens, New York.

If enacted, the bill would create a new, refundable tax credit to put more money in the pockets of the lowest income families at a time when renters’ wages have remained constant and housing costs have skyrocketed. Under Mr. Crowley’s bill, renters who pay more than 30% of their income on rent would be eligible for a refundable tax credit, based on the household’s annual income and the total amount it spends on rent each year. Individuals who live in federally subsidized housing would also be able to claim a refundable tax credit for one month’s rent.

“Millions of families – including those with the greatest needs – would no longer be forced to make impossible choices between paying for rent and covering other basic needs like food and healthcare,” stated NLIHC president and CEO Diane Yentel in a press statement supporting the bill. “By ensuring that the lowest income people have an affordable place to call home, a new tax credit for renters – like the one proposed by Representative Crowley – could transform millions of lives, giving struggling families the stability they need to achieve economic mobility, improve their health, and allow children to do better in school. I applaud Congressman Crowley for his leadership on this innovative, bold proposal.”

NLIHC member and New York Housing Conference Executive Director Rachel Fee spoke at Mr. Crowley’s press conference announcing the bill. “Too many families in New York City are struggling to afford rent each month,” she said. “As rents continue to outpace income, we need federal policy to support affordable rental housing, especially for low income families. Congressman Crowley’s bill will provide this needed relief to renters in New York and across the country.”

Contact your member of Congress today and ask them to support the Rent Relief Act of 2017 (HR 3670).

HUD Smoking Ban is in Effect

HUD Smoking Ban is in Effect

Remember, HUD has published a final rule for smoke-free policies in public housing and federally assisted multi-family properties.

See http://bit.ly/2ljD5ni for details.

National Housing Trust Fund Projects Are Getting Started

National Housing Trust Fund Projects Are Getting Started

The national Housing Trust Fund (HTF) is finally getting under way in 2017. About 20 states have awarded HTF projects, more will be making awards this winter, while the rest catch up in the spring and summer of 2018. Here are descriptions of four early projects.

Brattleboro, Vermont

The Lamplighter Inn Motel, a former extended-stay motel in Brattleboro is being transformed into the Great River Terrace with 22 supportive housing units. Eleven of the units will be permanent supportive housing for chronically homeless people. Four of the units will be HTF-assisted. After gutting the old motel’s 24 rooms, 22 micro-apartments with complete bathroom and kitchen facilities will be created around a central courtyard. A community center is being built on the property that will have a meeting room, laundry facilities, and two offices for supportive services.

Groundworks Collaborative, which operates Brattleboro’s only year-round homeless shelter, helped with the project design. Groundworks and Health Care & Rehabilitation Services of Vermont will deliver services to residents including substance abuse and mental health counseling, help with job search, budgeting, and other life skills education.

The developers are working with the transit agency to rework bus routes because residents will need access to downtown Brattleboro from the busy commercial strip where Great River Terrace is located.

St. Peter, Minnesota

The Southwest Minnesota Housing Partnership will build the Solace Apartments that will have 30 units, including 16 HTF-assisted and 13 HOME-assisted apartments. One apartment is market-rate for staff. The assisted units will include one-, two-, and three-bedroom units for families, singles, veterans, youth, homeless people, and individuals with serious and permanent mental illness, chemical dependencies, brain injuries, or physical or developmental disabilities.

Solace Apartments will have on-site supportive services for people at high risk of homelessness who have mental health or substance abuse challenges. There will be a focus on families with an individual who has recently been released from drug-related incarceration and is subject to court-ordered treatment protocols. Those tenants will be required to follow drug court rules, and there will be an onsite service provider.

Iowa City, Iowa

Shelter House in Iowa City is building 24 HTF-assisted one-bedroom apartments that will be permanent supportive housing for chronically homeless people. The two-story building, which will be called Cross Park Place, will have offices and exam rooms for providers of case management, healthcare, and behavioral health services.

The project is part of Shelter House’s Housing First initiative serving the segment of the homeless population who frequently visit emergency rooms and treatment centers and who are frequently arrested. Based on a mini-study, Shelter House estimates that their Housing First approach will save the community $140,000 per person each year because the people housed at Cross Park Place won’t be repeatedly going to the emergency room, treatment centers, jail, or court.

The Iowa City Housing Authority has committed Section 8 vouchers to Cross Park Place through a Special Admissions program. The Special Admission program mirrors the HUD-VASH voucher program: someone who meets the project’s criteria (chronic homelessness) goes to the top of the voucher waiting list to fill a vacancy when a person living in the project with a Special Admissions voucher moves out.

Oklahoma City, Oklahoma

The Metro Alliance in Oklahoma City is building the “Men’s Lodge,” which will have 20 single-occupancy rooms for men who have a substance abuse disorder, often diverting them from incarceration. Thirteen of the units will be for extremely low income men thanks to an HTF award. The men who will live there will be a part of the Metro Alliance Firststep initiative, which, in addition to affordable housing, provides case management and life skills education. Metro Alliance also provides residents with transportation to jobs that help cover program costs.

Small Area FMRs on Hold for At Least Two Years

Small Area FMRs on Hold for At Least Two Years

HUD announced on August 11, 2017 a two-year freeze on the requirement for public housing agencies (PHAs) in 23 metro areas to use Small Area Fair Market Rents (SAFMRs). This stalls an opportunity to expand housing choice for voucher households by reducing one of the barriers to moving to higher-rent neighborhoods with better schools, less crime, more jobs, and other amenities like full-service grocery stores. HUD justifies the freeze by claiming it needs to wait until a final evaluation of a seven-PHA demonstration is completed and by pointing to objections raised by PHA industry groups. HUD should reactivate the rule immediately so that voucher households have more opportunities to use their vouchers in neighborhoods of their choice.

What is a Small Area FMR (also known as a SAFMR)?

Using Small Area FMRs would base the value of a Housing Choice Voucher on rents in ZIP codes. Normally, the value of a voucher to a landlord is affected by the Fair Market Rent (FMR) based on rents in an entire metro area. Many metro areas have neighborhoods within them that have very different market rents. Setting payment standards (and the value of a voucher) based on a metro-wide rent calculation makes the value of a voucher too low to afford rents in some areas and higher than market rents in other neighborhoods.

The idea behind using Small Area FMR payment standards is to have the value of vouchers more in line with actual neighborhood rents. Using SAFMR payment standards would increase the value of vouchers in higher rent neighborhoods that generally have better schools, less crime, more job opportunities, more robust resources like full-service grocery stores, and fewer environmental hazards, providing voucher holders more options when choosing where to live. If a voucher’s value is significantly lower than the rent in a high opportunity neighborhood, a household may have difficulty finding a landlord who will accept the voucher. Some households may be forced to pay more than 30% of their income for rent (paying the amount needed to meet the landlord’s market rent on top of what the voucher pays) to live in a high-opportunity neighborhood.

The flip side of SAFMRs is that in lower-rent neighborhoods, where a voucher’s value is currently often greater than market rents, the voucher payment the landlord receives would go down, and landlords would no longer be getting more rent from voucher holders than they would from a renter without a voucher.

HUD Issued a Rule Requiring Small Area FMRs in 24 Metro Areas

After years of public input, HUD issued a rule on November 16, 2016 requiring PHAs in 24 metro areas use SAFMRs. Small Area FMRs would have to be used by all PHAs in those 24 metro areas, not just the PHA in the major city. For example, there are 19 PHAs in the Philadelphia metro area that would have to use SAFMRs, not just the Philadelphia Housing Authority. PHAs in other locations not included in the 24 metro areas could voluntarily use SAFMRs. The recent suspension is for all of the metro areas included in the initial rule, except for the Dallas-Plano-Irving area, which is required to continue using SAFMRs due to a court settlement.

NLIHC has long supported the use of SAFMRs in certain metro areas, but has concerns about the potential harm to current voucher holders whose voucher may lose value if they live in a low-cost ZIP code. Landlords in these neighborhoods may no longer accept vouchers or may continue to charge higher rents, requiring voucher households to pay the difference. Such households would have to pay more than the usual 30% of their income on rent and risk eviction.

NLIHC supports expanding housing choice through the use of SAFMRS and, because many households are likely to want to stay in their current homes and neighborhoods, we advocate that current voucher holders must be protected from the lowering of voucher values in neighborhoods with lower market rents. HUD has not addressed the issue of protecting current voucher holders and has indicated no plans to do so.

NLIHC urges HUD to reactivate the rule requiring the use of SAFMRs in the 24 designated metro areas, without a reduction in voucher values for households that had vouchers before the SAFMR rule went into effect – to protect current voucher holders and expand housing choice for voucher holders who wish to move to higher opportunity neighborhoods.