On December 22, 2018, the federal government began a partial shutdown when Congress and President Trump could not agree on an appropriations bill or continuing resolution that would continue to fund certain federal agencies, including HUD and USDA. Now the longest in U.S. history, this shutdown threatens to create hardships for subsidized housing owners who rely on rental assistance contracts with HUD or USDA which cover a portion of tenants’ rents, and the tenants who rely on these contracts to help them afford their housing.

More than 1,700 HUD contracts have either expired or are set to expire by the end of February. Between December 1, 2018 and January 15, 2019, 702 contracts expired. Another 1,029 are set to expire by the end of February (see NLIHC’s map of expired and soon-to-expire HUD contracts). These contracts support 59,116 rental homes for seniors, people with disabilities, and the lowest income families. The programs include Section 8 Project-Based Rental Assistance (PBRA) (23,038 assisted units), Section 202 housing for low-income seniors (28,544), and Section 811 housing for people with disabilities (6,764 assisted units).[1] While Section 202 and 811 housing serve exclusively seniors and people with disabilities, one-quarter of Section 8 PBRA serves very low-income single-parent households with children. All three programs serve some of the most financially vulnerable individuals and families in the country. The average annual income of renters relying on Section 8 PBRA, Section 202, and Section 811 for stable, affordable housing is $12,505, $13,349, and $11,459, respectively.[2] They cannot afford their housing without the assistance provided by these rental contracts.

Owners without income from these rental assistance contracts need to rely on their reserve funds to cover ongoing operating expenses, such as mortgage debt payments, maintenance, and property management. The extent of these reserves and how long this shutdown will continue are unclear. Owners, however, cannot operate their buildings without income from the rental contracts indefinitely.

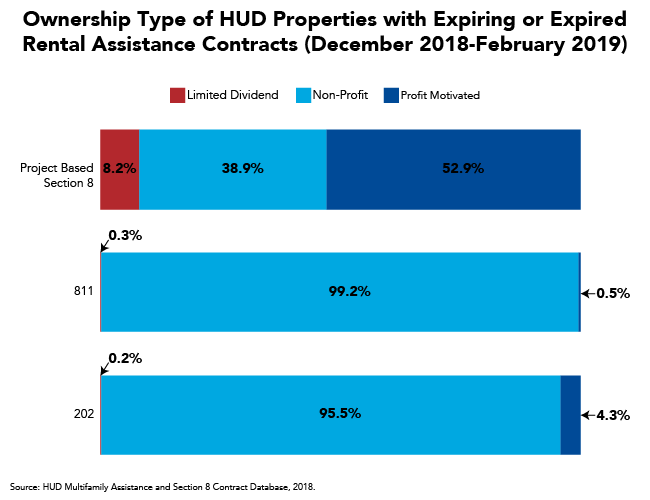

Fifteen percent of owners are for-profit entities who might be more interested in maximizing profit under these circumstances than continuing to meet the housing needs of the poorest and most vulnerable households. Given an opportunity, some of these owners will likely be inclined to raise rents, or even attempt to leave the affordable housing programs permanently. The media has highlighted at least one owner already threatening tenants with eviction and another property management company that sent rent hike letters to tenants in 28 building in four states. Both examples involved USDA Rural Development (RD) rental assistance. Advocates fear landlords with expired HUD contracts may do the same.

Eighty-three percent of owners of these expired or expiring HUD contracts are non-profit organizations. They are often driven by their social mission and, as a result, are likely to exert more effort in trying to keep their units affordable to current tenants while the shutdown continues. They, however, will likely struggle to pay for operations as the shutdown persists. Mission-driven owners will eventually need to find additional forms of support to address their operating costs if the shutdown depletes their operating reserves.

Ownership type varies significantly by program. Section 202 and Section 811 properties are owned almost exclusively by non-profit entities, while more than half of properties with Section 8 PBRA are owned by for-profits. According to the National Housing Law Project (NHLP), tenants living in 202 and 811 housing where the contract has expired appear to be legally protected from rent increases or displacement. Moreover, it is unlikely that the non-profit owners of this housing would attempt to raise rents or displace their tenants even if they could. According to HUD, the agency can use carryover funds to renew expired 811 contracts from December and January, while the vast majority of properties with 202 rental assistance contracts have reserves to cover operating expenses in the short-term. The accuracy of these claims, however, is difficult to assess.

It is a different story, however, for units with expired Section 8 PBRA contracts, where a significant proportion of properties are owned by for-profit organizations and legal protections against rent increases or displacement for tenants are less clear. NHLP recently released a shutdown-related summary of HUD tenants’ legal rights, which advocates should review.

The partial government shutdown is the longest in U.S. history and, as of this writing, there appears to be no end in sight. Congress and the Administration must act immediately to fund HUD and avoid the potentially disastrous consequences of an even longer shutdown for both property owners and tenants.

The government’s failure to meet its financial obligations to HUD-assisted property owners and tenants constitutes a severe breech of the trust required to maintain current and future public-private partnerships. Secretary Carson has consistently promoted such partnerships as the ideal means of delivering housing assistance. If the Secretary is sincere in his beliefs, he should demand unconditional and immediate funding of the HUD budget.

[1] An additional 770 units are assisted through HUD’s Rent/Supp program.

[2] HUD Picture of Subsidized Households.