Location Efficiency in the Low Income Housing Tax Credit Program

Jan 17, 2017

A study published in Housing Policy Debate titled “How Location Efficient is LIHTC? Measuring and Explaining State-Level Achievement” by Arlie Adkins, Andrew Sanderford, and Gary Pivo finds that recently built rental housing funded by the Low Income Housing Tax Credit (LIHTC) is more likely to be in “location-efficient” neighborhoods than the overall housing stock. The study finds that state policies, specifically state qualified allocation plans (QAPs), and an active non-profit sector are key factors in the location efficiency of the LIHTC rental stock.

Location efficiency describes the accessibility of a given location to daily destinations, such as employment. Higher location efficiency is thought to lower transportation costs, which are often residents' largest expense after housing. Higher location efficiency has also been shown to be associated with improved public health and environmental outcomes, as location-efficient neighborhoods tend to be more walkable, possibly increasing physical activity and reducing vehicle emissions.

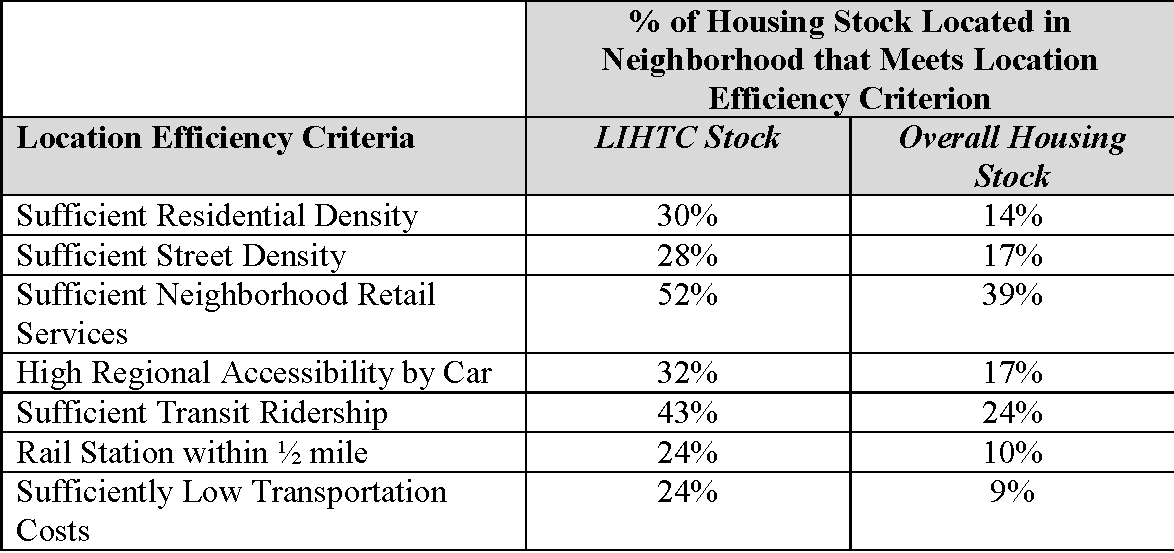

The authors examined the neighborhood location efficiency of LIHTC housing built between 2007 and 2011. Neighborhood location efficiency was represented by seven criteria: residential density of at least 7 housing units per acre, sufficient street density, sufficient neighborhood retail services, high regional accessibility by car, transit use by at least 5% of the neighborhood’s working population, a fixed rail station within ½ mile, and transportation costs of 20% or less of household income for a single-parent household earning 50% of median income. The neighborhoods were represented by census block groups.

The LIHTC stock appears to be more location efficient than either the rental or overall housing stock. Thirty-five percent of LIHTC units were located in neighborhoods that met at least three of the criteria for location efficiency, compared to only 28% of rental units and 16% of the overall housing stock.

The authors found significant state variation in the location efficiency of LIHTC housing. The state’s underlying built environment had a significant impact. States with a greater share of LIHTC units with non-profit sponsors and a qualified allocation plan (QAP) that incentivized projects in proximity to necessary services also had an impact on location efficiency. The authors suggest that state affordable housing policy makers and nonprofit developers can play a significant role in creating greater location efficiency in the LIHTC stock.

How Location Efficient is LIHTC? Measuring and Explaining State-Level Achievement is available at: http://bit.ly/2jDYEcq