NLIHC Releases "Out of Reach 2019": National Housing Wage is Nearly $23 Per Hour for a Modest Two-Bedroom Rental

Jun 24, 2019

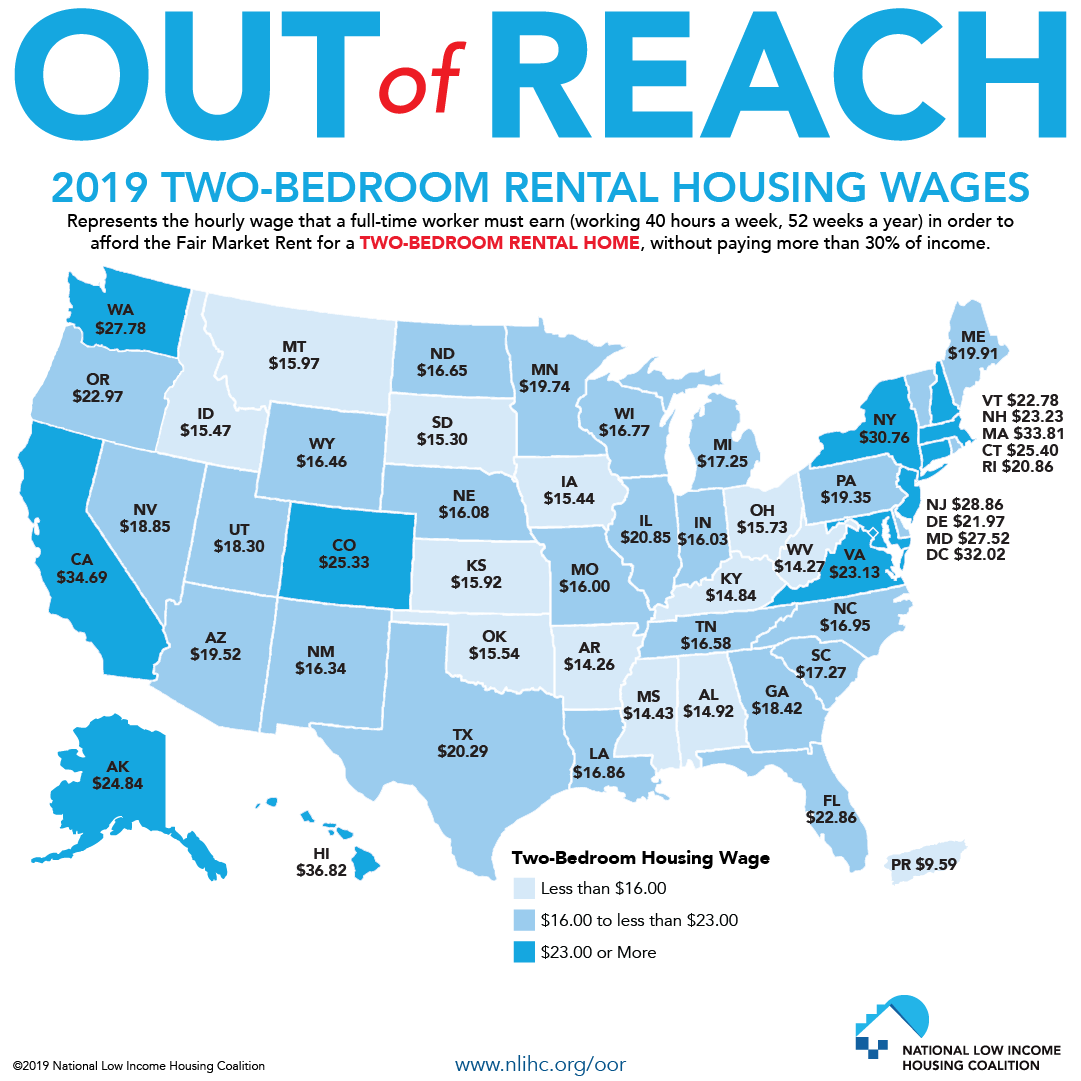

NLIHC released on June 18 the 30th anniversary edition of its report Out of Reach, which documents the significant gap between renters’ wages and the cost of rental housing throughout the U.S. The national Housing Wage - the hourly wage a full-time worker must earn to afford a rental home at HUD’s fair market rent without spending more than 30% of his or her income on housing - is $22.96 for a modest two-bedroom rental home and $18.65 for a one-bedroom rental home.

A full-time worker with a standard 40-hour work week earning the federal or prevailing state minimum wage cannot afford a two-bedroom rental home at fair market rent in any U.S. county and can afford a one-bedroom rental in fewer than 99% of counties (28 out of more than 3,000 counties) nationwide. On average, a worker earning the federal minimum wage of $7.25 an hour must work 127 hours every week (3 full-time jobs) to afford a modest two-bedroom rental home ($1,194/month) or 103 hours every week (2.5 full-time jobs) to afford a one-bedroom rental home ($970/month).

Out of Reach provides the Housing Wage for every state, metro area, county, and metro-area ZIP code in the U.S. The Housing Wage for a two-bedroom rental home ranges from $60.96 per hour in San Francisco to $11.88 per hours in areas of Kentucky. Even in areas with lower Housing Wages, however, extremely low-income people and families cannot afford their homes because their incomes tend to be much lower.

Seven of the ten U.S. occupations projected to grow the most over the next decade provide a median wage that is less than what a full-time worker needs to earn to afford a one-bedroom rental home. The gap between what workers earn and what they need to earn to afford rental housing is even greater for people of color.

The report notes the inability of the private rental market to serve the lowest-income renters, as landlords in strong markets have incentives to upgrade their properties and charge higher rents to higher-income households, while landlords in weak markets have no incentive to maintain their properties once revenue from rent is lower than operating and maintenance costs. To address this market failure, the report emphasizes the need for increased federal investments in the national Housing Trust Fund to create and preserve rental housing for extremely low-income renters, adequate federal funding to renew Project-Based Rental Assistance contracts with private owners of subsidized rental housing, expanded rental assistance through the Housing Choice Voucher program, and changes to the tax code, such as an income-targeted renters tax credit for housing cost-burdened renters.

The Out of Reach 2019 report and interactive website are available at: https://reports.nlihc.org/oor