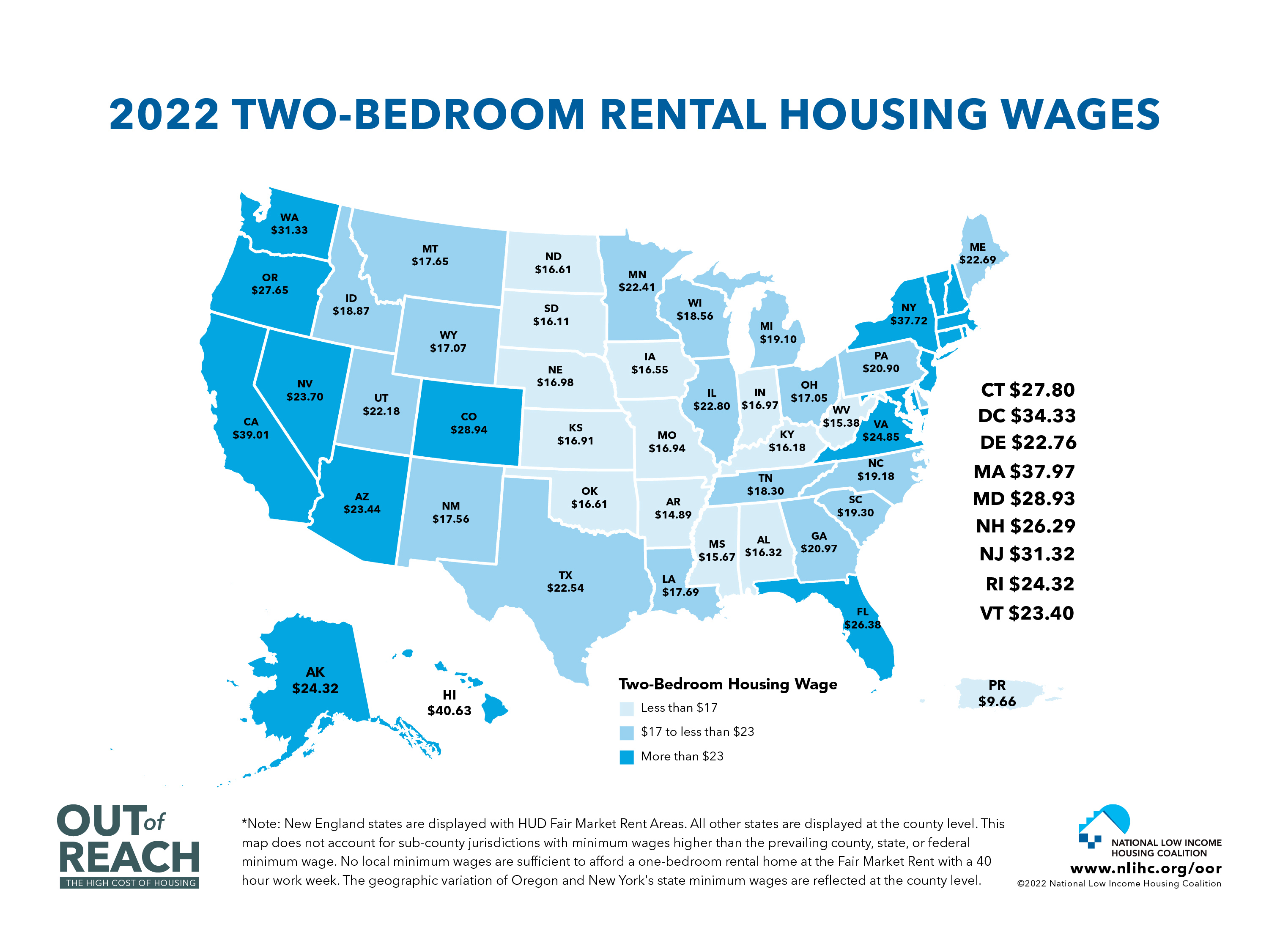

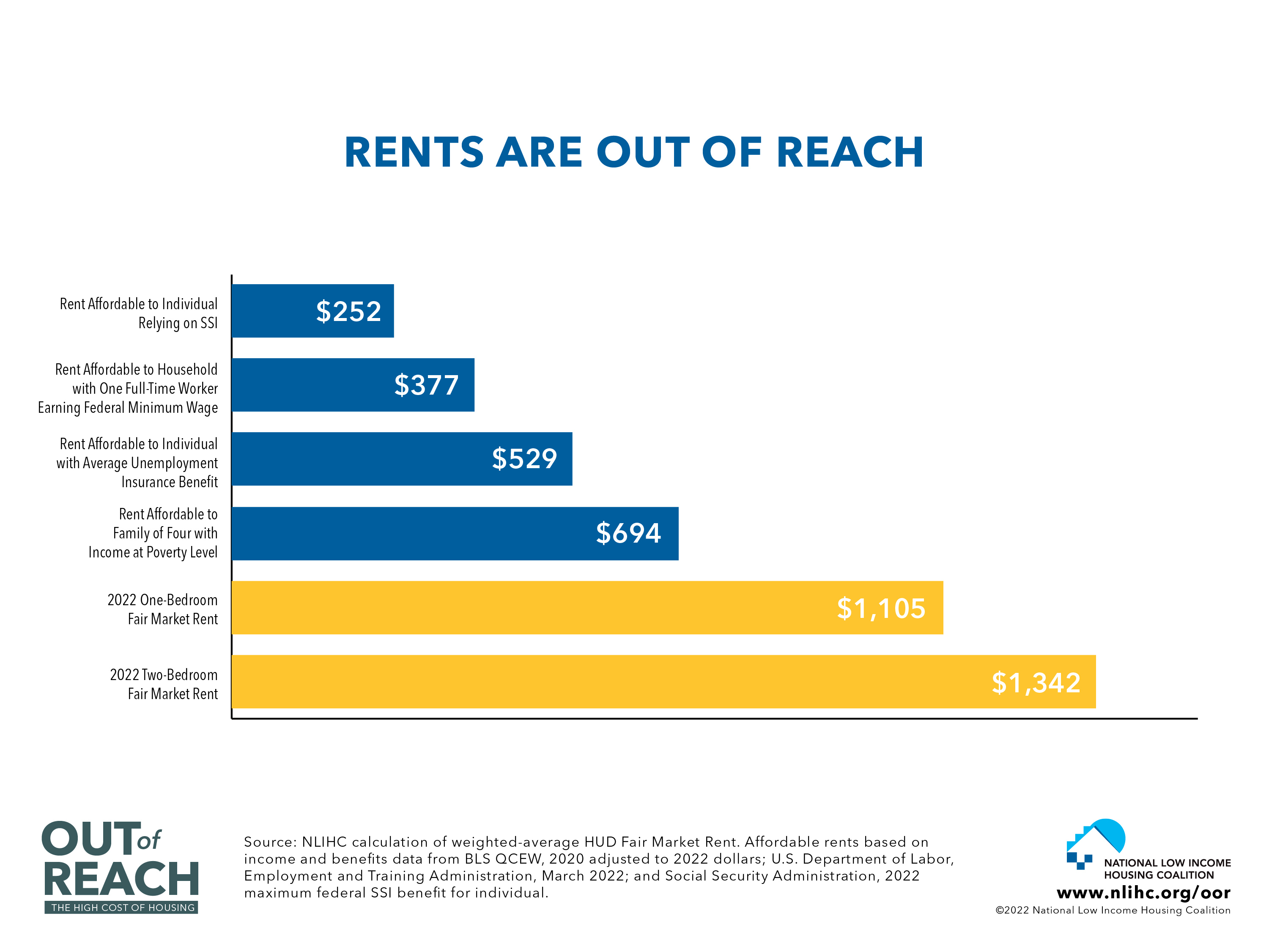

NLIHC released its annual report, Out of Reach: The High Cost of Housing. This year’s report shows that low-wage workers are facing severe challenges in affording housing amid record-breaking rent increases. The report highlights the mismatch between the wages people earn and the price of decent rental housing in every state, metropolitan area, and county in the U.S. The report also calculates the “Housing Wage” a full-time worker must earn to afford a rental home without spending more than 30% of their income on housing costs. This year’s national Housing Wage is $25.82 per hour for a modest two-bedroom home at fair market rent and $21.25 per hour for a modest one-bedroom home.

Temporary housing policy measures implemented during the COVID-19 pandemic, including emergency rental assistance and eviction moratoriums, are coming to an end. At the same time, renters are facing record-high rental prices, putting decent and affordable homes even further out of reach. As housing costs soar, 11 million extremely low-income renter households are facing difficult decisions about how to pay for basic necessities.

Nationwide, rent increases have made affording and maintaining housing even more difficult for the lowest-income renters. Across the country, rents rose 18% between the first quarter of 2021 and the first quarter of 2022. These rent increases have been widespread: out of 345 metropolitan counties, all but two have seen a rise in rental prices since 2021. The increases have been spurred by several factors, including increased rental demand, low vacancy rates, and increased investor purchases. Simultaneously, costs for many other basic needs have risen amid the highest inflation in 40 years. With rents skyrocketing and prices for goods increasing, workers may have to sacrifice necessities like food, medical services, transportation, and childcare simply to remain housed.

Out of Reach 2022 shows that the gap between wages and housing costs is largest for people of color, and particularly women of color. The disparities are the result of historic and continuing racist housing policies that have led to people of color facing disproportionate challenges accessing decent and affordable homes. At the same time, Black and Latino workers earn less than white workers: the median wage for Black and Latino workers is approximately $6.00 less than that of the median white worker. Because people of color are more likely to be renters at all income levels, increasing costs within the rental market disproportionately harm these households. Among renters, 55% of Black households are cost-burdened and 53% of Latino households are cost-burdened, compared to 43% of white households. The disparities grow even starker for women of color: more than 70% of Black and Latina women earn an hourly wage that fall short of the one-bedroom Housing Wage. A white male earning the median wage makes almost $27 per hour – a wage that is above the two-bedroom Housing Wage – while Black and Latina women earning the median wage make less than $20 per hour, which is below the Housing Wage for a one-bedroom apartment.

As rental prices rise, evictions resume, and COVID-19 policy measures expire, low-income renters will face insurmountable hardships finding and maintaining affordable housing without significant congressional action. NLIHC and our partners across the country are calling on Congress to address the far-reaching challenges that low-income renters face in accessing safe and affordable housing. Solving the housing affordability crisis requires expanding rental assistance to all eligible renters in need while also making deep, sustained investments in the national Housing Trust Fund and public housing to create, preserve, and rehabilitate affordable homes. Congress should also create a permanent National Housing Stabilization Fund to provide temporary assistance for households at risk of eviction and strengthen and enforce renters’ protections.

The full Out of Reach 2022 report – as well as interactive data for each state, county, and metro area – are available at: https://nlihc.org/oor