NLIHC released Out of Reach 2023: The High Cost of Housing. Published annually, the Out of Reach report highlights the gulf between the wages people earn and the price of modest rental housing in every state, county, metropolitan area, and combined non-metropolitan area in the U.S. This year’s report shows how high rents resulting from rapid rent growth during the pandemic and the end of many pandemic-era benefit programs are combining to exacerbate the financial insecurity of low-income renters, leading to higher eviction filing rates and increased homelessness in some communities.

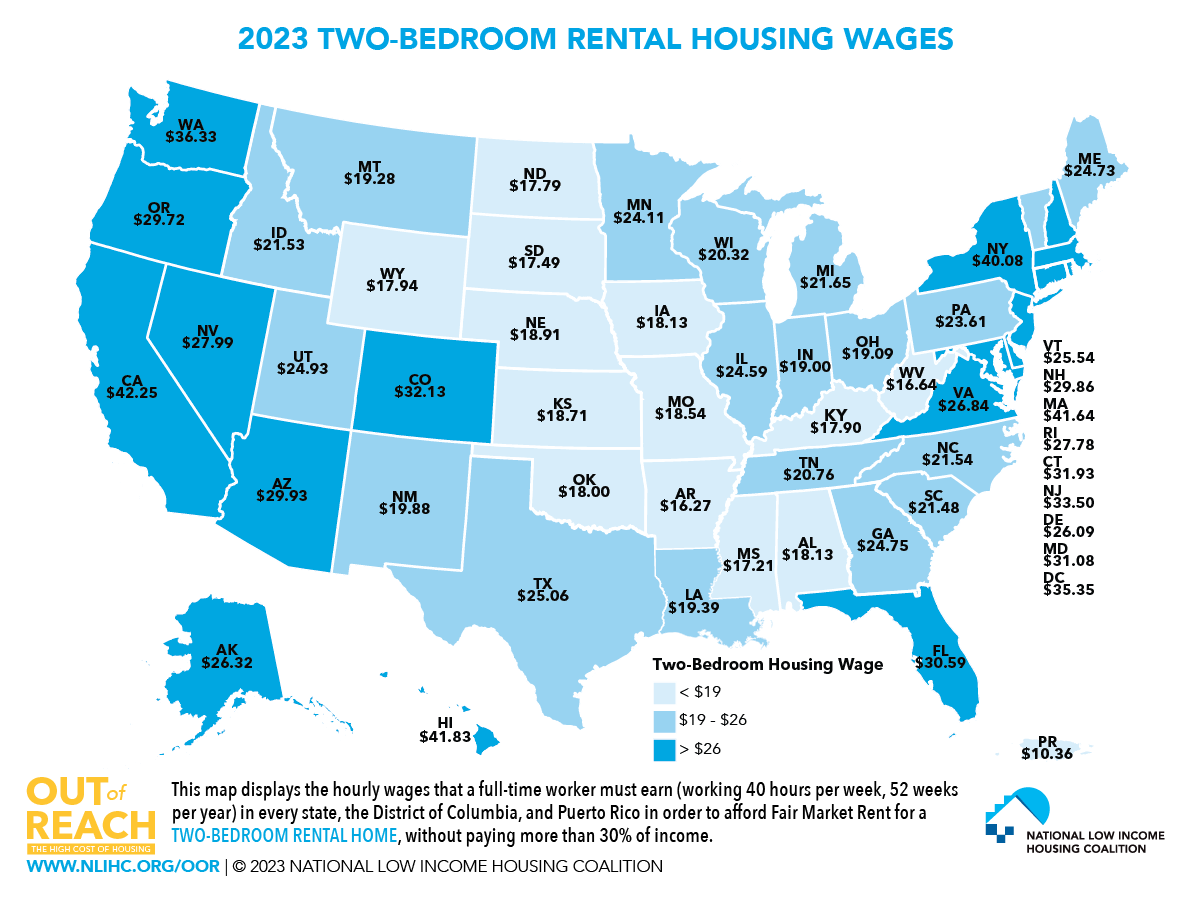

Even amid slowing rent growth, low-income renters are facing the effects of a long-standing trend in which rents have risen faster than wages and decent, affordable housing remains out of reach. Like past reports, this year’s report also provides a “Housing Wage” – an estimate of the hourly wage full-time workers must earn to afford a rental home at fair market rent without spending more than 30% of their incomes. Nationally, the 2023 Housing Wage is $28.58 per hour for a modest two-bedroom rental home and $23.67 for a modest one-bedroom rental home.

In addition to the national Housing Wage, Out of Reach provides Housing Wages for each state, metropolitan area, county, and combined non-metropolitan area within a state. For a modest two-bedroom apartment, the average Housing Wage ranges from $16.27 in Arkansas to $42.25 in California (see map below). States with lower housing costs also tend to have lower wages, so the lowest-wage workers in every state struggle to pay their rent.

Out of Reach 2023 shows that housing is out of reach for workers across a range of occupations and wage levels. Sixty percent of all workers earn an hourly wage that is less than the two-bedroom Housing Wage, and nearly 50% of workers earn an hourly wage that is less than the one-bedroom Housing Wage. Thirteen of the 20 most common occupations in the U.S. pay median wages that are lower than the two-bedroom Housing Wage, and 10 of these occupations, which account for more than one-third of the workforce, pay median wages that are lower than the national one-bedroom Housing Wage. The problem is acute and widespread for the lowest-wage workers. In no state, metropolitan area, or county can a full-time minimum-wage worker afford a modest two-bedroom rental home. A full-time minimum-wage worker cannot afford a modest one-bedroom rental home in over 92% of U.S. counties.

As the report shows, the gap between wages and housing costs is largest for people of color, and particularly women of color. The disparities are the result of historic and continuing racist housing policies that have led to people of color facing disproportionate challenges accessing decent and affordable homes. At the same time, Black, Latino, and Native American workers are more likely than white workers to be employed in sectors with lower median wages, like service, consumer-goods production, and transportation, while white workers are more likely to be employed in higher-paying management and professional positions. Even within the same professional occupations, however, the median earnings for white workers are often higher than the median earnings for Black, Latino, and Native American workers. Because people of color are more likely to be renters at all income levels, increasing costs within the rental market disproportionately harm these households. Extremely low-income renters account for 19% of Black households, 17% of American Indian or Alaska Native households, and 14% of Latino households, but only 6% of white households. Nationally, the median wage of a full-time white worker is $2.23 higher than the one-bedroom Housing Wage, but the median wage of a full-time Black and Latino worker is approximately $.73 and $1.84 less than the one-bedroom Housing Wage, respectively. The disparities grow even starker for women of color: Black and Latina female workers earn median wages that are $3.96 and $5.47 less, respectively, than the one-bedroom Housing Wage.

As low-income renters face high rents and increasing housing instability without the supports provided by pandemic-era benefit programs, safe, stable, and affordable housing remains out of reach. NLIHC and our partners across the country are calling on Congress to address the far-reaching challenges that low-income renters face in finding and maintaining decent, accessible, and affordable housing. Addressing the roots of the housing affordability problem requires a sustained commitment to investing in new affordable housing, preserving affordable rental homes that already exist, bridging the gap between incomes and rent through universal rental assistance, providing emergency assistance to stabilize renters when they experience financial shocks, and establishing strong renter protections.

The full Out of Reach 2023 report, as well as interactive data for each state, county, and metro area, are available at: https://nlihc.org/oor